There's a regulatory landmine hiding in plain sight across millions of business communications. While companies invest heavily in GDPR compliance, data protection, and regulatory adherence, they unknowingly create massive liability exposure through something as simple as shortened links in their marketing emails and customer communications.

The compliance trap emerges from a fundamental misunderstanding of how data protection laws classify link shortening services. When your business uses external link shorteners, you're not just outsourcing a technical function—you're creating third-party data processing relationships that trigger complex regulatory obligations under GDPR, CCPA, HIPAA, and financial services regulations.

Most businesses discover this compliance gap only when facing regulatory audits, customer complaints, or legal discovery processes. By then, the exposure has compounded across thousands of customer interactions, and the remediation costs often exceed the fines themselves.

The Hidden Data Processing Relationship

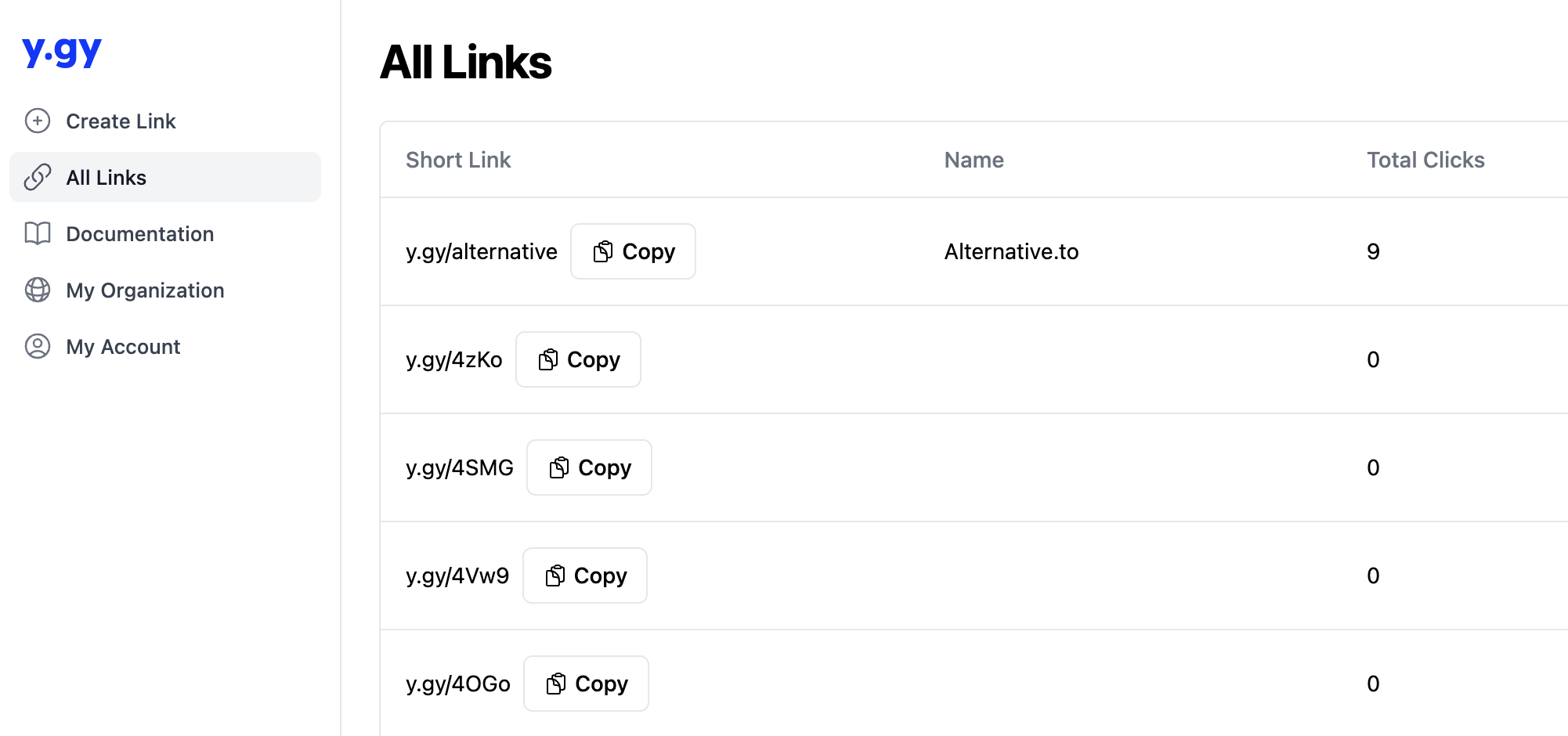

Every shortened link creates a data processing relationship that most businesses never document or manage according to regulatory requirements. When someone clicks a y.gy/example link, multiple data points get collected: IP addresses, device information, timestamp data, referrer information, and behavioral patterns. Under GDPR and CCPA, this constitutes personal data processing that requires explicit legal foundations and transparency disclosures.

The complexity multiplies when you realize that link shortening involves multiple data controllers and processors. The business creating the link acts as a data controller, the link shortening service becomes a data processor, and any analytics or tracking systems become additional processors. Each relationship requires proper legal documentation, data processing agreements, and compliance oversight.

Most free link shortening services explicitly disclaim regulatory compliance responsibilities in their terms of service. Bit.ly's terms state that users are "solely responsible for ensuring compliance with applicable data protection laws." TinyURL provides no compliance guidance whatsoever. When regulatory issues arise, businesses discover they've been operating without proper legal cover for their link infrastructure.

Deutsche Bank learned this lesson during a 2023 GDPR audit when regulators discovered they had been using free link shortening services in customer communications without proper data processing agreements. The bank faced €2.3 million in fines, not for the links themselves, but for failing to document and manage the third-party data processing relationships those links created.

The Geographic Data Transfer Problem

Link shortening services often process data across multiple jurisdictions without regard for international data transfer restrictions. When a European customer clicks a shortened link, their personal data might be processed in servers located in the United States, Asia, or other regions without adequate protection frameworks.

Under GDPR, international data transfers require specific legal mechanisms: adequacy decisions, standard contractual clauses, or binding corporate rules. Most link shortening services don't provide these protections, making every international link click a potential violation of data transfer restrictions.

The geographic problem becomes particularly acute for financial services companies subject to data localization requirements. Banking regulations in the EU, UK, and several other jurisdictions require customer data to remain within specific geographic boundaries. Using link shortening services that process data globally can violate these regulations even when the underlying business communication is completely compliant.

HSBC discovered this challenge when implementing their digital marketing strategy across multiple countries. Their legal team identified that using global link shortening services would violate banking data localization requirements in 12 of their operating jurisdictions. They were forced to build separate link infrastructure for each region, a project that cost $4.7 million and delayed their digital transformation by eight months.

The Consent and Transparency Requirement

GDPR and CCPA require businesses to provide clear, specific information about data processing activities before collecting personal data. This includes third-party services that process customer data, even indirectly through link interactions.

Most businesses fail to include link shortening services in their privacy policies or cookie notices. They don't obtain proper consent for the data processing that happens when customers click shortened links. They don't provide transparency about which third parties will receive customer data through link analytics.

The consent requirements become particularly complex when link shortening services use data for their own business purposes. Many free services explicitly retain rights to analyze aggregated click data for improving their algorithms or targeting advertising. Under privacy regulations, this secondary use of customer data requires additional consent and disclosure.

Spotify faced this compliance challenge when implementing their viral marketing campaigns. Their legal team discovered that their link shortening strategy was collecting customer data for third-party analytics without proper consent mechanisms. The remediation required updating privacy policies in 27 countries, implementing new consent flows, and rebuilding their link attribution system to ensure compliance. The total cost exceeded $890,000 in legal and technical expenses.

The Financial Services Regulatory Layer

Financial services companies face additional regulatory complexity around link infrastructure. Banking regulations require comprehensive audit trails for all customer communications. Securities regulations mandate specific disclosures and record-keeping for investment-related communications. Payment processing regulations impose data security standards that extend to all customer touchpoints.

Using external link shortening services creates gaps in these regulatory requirements. Banks can't provide complete audit trails when links redirect through third-party services. Investment firms can't ensure proper disclosure compliance when shortened links obscure the destination of regulatory communications. Payment processors can't maintain required security standards when customer data flows through uncontrolled third-party systems.

The regulatory complexity multiplies in cross-border financial services. A bank operating in the EU, US, and Asia must comply with three different sets of financial regulations, each with specific requirements for customer communication infrastructure. External link shortening services rarely provide the jurisdictional compliance features these businesses require.

JPMorgan Chase discovered this regulatory complexity when implementing their digital customer engagement strategy. Their compliance team identified 47 different regulatory requirements across their global operations that were incompatible with using external link shortening services. Building compliant internal infrastructure required 18 months and $12 million in development costs, but the alternative was continued regulatory exposure across their entire customer communication system.

The Healthcare and HIPAA Implications

Healthcare organizations face particularly strict requirements under HIPAA and similar health data protection regulations. Any service that processes patient information must meet specific security and privacy standards. This includes link shortening services used in patient communications, appointment reminders, or health education materials.

Most link shortening services don't provide Business Associate Agreements (BAAs) required under HIPAA. They don't implement the technical safeguards necessary for protecting health information. They don't provide the audit capabilities required for HIPAA compliance monitoring.

The healthcare compliance problem extends beyond direct patient communications. Research organizations, pharmaceutical companies, and health technology companies often use shortened links in their communications without realizing they're creating HIPAA compliance risks.

Kaiser Permanente identified this compliance gap during a 2024 privacy audit. They discovered that shortened links in their patient education emails were processing patient data through services that didn't meet HIPAA requirements. The remediation required rebuilding their entire patient communication system and implementing new compliance monitoring processes. The project cost $3.2 million and took 14 months to complete.

The Litigation and Discovery Risk

Link infrastructure creates discoverable evidence in legal proceedings. When businesses face litigation, regulatory investigations, or compliance audits, their link infrastructure becomes part of the evidentiary record. External link shortening services often can't provide the detailed records and cooperation required for legal discovery processes.

This creates several compliance risks. Businesses may be unable to produce complete records of customer communications when required by legal proceedings. They may face sanctions for failing to preserve evidence that exists in third-party systems they don't control. They may discover that their link infrastructure contains evidence that supports claims against them.

The litigation risk becomes particularly pronounced in class-action privacy lawsuits. Plaintiffs' attorneys increasingly target businesses that use non-compliant third-party services for data processing. Link shortening services that don't meet regulatory requirements become evidence of systematic privacy violations.

Equifax experienced this litigation complexity during their data breach settlement proceedings. Investigators discovered that their use of external link shortening services had created additional data exposure beyond the primary breach. The link infrastructure became part of the evidentiary record and contributed to increased settlement costs because it demonstrated ongoing privacy compliance failures.

The Regulatory Audit Trail

Compliance auditors increasingly scrutinize third-party data processing relationships, including seemingly minor services like link shortening. Auditors want to see proper vendor risk assessments, data processing agreements, compliance monitoring, and incident response procedures for all services that process customer data.

Most businesses can't provide adequate documentation for their link shortening services because they never treated these services as compliance-relevant vendors. They don't have proper contracts, security assessments, or monitoring procedures in place.

The audit trail problem compounds over time as businesses accumulate more third-party relationships without proper compliance oversight. What starts as a simple convenience tool becomes a systematic compliance gap that's difficult and expensive to remediate.

The Cost of Compliance Remediation

When businesses discover their link infrastructure compliance gaps, remediation costs often exceed the investment required for compliant solutions from the beginning. The remediation process typically involves several expensive components: legal review of existing relationships, privacy policy updates across multiple jurisdictions, consent mechanism implementation, system integration development, and ongoing compliance monitoring.

The remediation costs multiply when businesses operate across multiple jurisdictions or industries with different regulatory requirements. A global financial services company might need to implement different compliance frameworks for EU banking regulations, US securities laws, and Asian data protection requirements.

Microsoft documented their link infrastructure compliance remediation project in their 2023 regulatory filing. The project required 24 months and $18 million to implement compliant link infrastructure across their global operations. The primary drivers were GDPR compliance requirements in Europe and financial services regulations in multiple jurisdictions. The remediation could have been avoided with proper compliance consideration during their initial link infrastructure decisions.

The Competitive Advantage of Compliance

Businesses that build compliance into their link infrastructure from the beginning gain competitive advantages in regulated industries. They can confidently pursue enterprise customers who require regulatory compliance. They can operate across multiple jurisdictions without compliance limitations. They can respond quickly to new regulatory requirements without infrastructure constraints.

The compliance advantage becomes particularly valuable in B2B sales where regulatory adherence is a qualification criterion. Enterprise customers increasingly require vendors to demonstrate comprehensive compliance across all business processes, including seemingly minor technical services.

Salesforce has built their entire go-to-market strategy around compliance differentiation. Their link infrastructure meets requirements for financial services, healthcare, government, and international data protection regulations. This compliance foundation enables them to compete for enterprise deals that exclude competitors with non-compliant infrastructure.

The Proactive Compliance Strategy

The most successful businesses treat link infrastructure compliance as a strategic investment rather than a regulatory burden. They implement compliant solutions that not only meet current requirements but provide flexibility for evolving regulations.

Proactive compliance strategies involve several key components: jurisdictional requirement analysis, vendor risk assessment, data processing agreement development, privacy policy integration, consent mechanism implementation, and ongoing compliance monitoring.

The proactive approach typically costs less than reactive remediation because it avoids the need to rebuild existing systems and processes. It also provides competitive advantages that justify the investment through improved sales opportunities and reduced regulatory risk.

The Regulatory Technology Integration

Modern compliance requires technology solutions that integrate regulatory requirements into business processes rather than treating them as separate obligations. Link infrastructure should include built-in compliance features: geographic data processing controls, consent management integration, audit trail generation, and regulatory reporting capabilities.

The integration approach reduces ongoing compliance costs by automating much of the monitoring and documentation required for regulatory adherence. It also reduces human error risks that often create compliance violations in manual processes.

The Future of Regulatory Link Infrastructure

Privacy regulations continue evolving toward more stringent requirements for third-party data processing relationships. The trend across jurisdictions is toward greater transparency, stronger consent requirements, and more comprehensive vendor accountability.

Businesses that invest in compliant link infrastructure now position themselves for success under future regulatory frameworks. Those that continue relying on non-compliant solutions face increasing regulatory exposure and remediation costs.

The regulatory landscape rewards businesses that take privacy and compliance seriously across all business processes. Link infrastructure compliance is becoming a competitive differentiator rather than just a legal requirement.

Breaking Free from the Compliance Trap

The compliance trap exists because businesses underestimate the regulatory implications of seemingly simple technology decisions. Link shortening appears to be a minor technical service, but it creates complex data processing relationships that trigger comprehensive regulatory obligations.

Breaking free requires recognizing that regulatory compliance is a business strategy issue, not just a legal requirement. Compliant infrastructure enables business opportunities, reduces risk exposure, and creates competitive advantages that justify the investment.

The businesses that master regulatory compliance in their digital infrastructure position themselves for sustainable growth in increasingly regulated markets. They avoid the hidden costs of compliance violations while capturing the competitive advantages of regulatory leadership.

Your link infrastructure isn't just a technical decision—it's a compliance strategy that affects your ability to operate in regulated markets, serve enterprise customers, and avoid regulatory exposure. The question isn't whether you can afford compliant link infrastructure. It's whether you can afford the regulatory risks of non-compliant alternatives.